Stephen Temes is the cofounder of EarlyShares, a premier Equity-Based Crowdfunding platform founded in 2011. Stephen and his team created this technology to help entrepreneurs raise capital from the crowd – from everyday people like you.

Today Stephen shares his entrepreneurial story, and also some valuable business advice for new startups.

Please tell us a little bit about your company – what is EarlyShares all about?

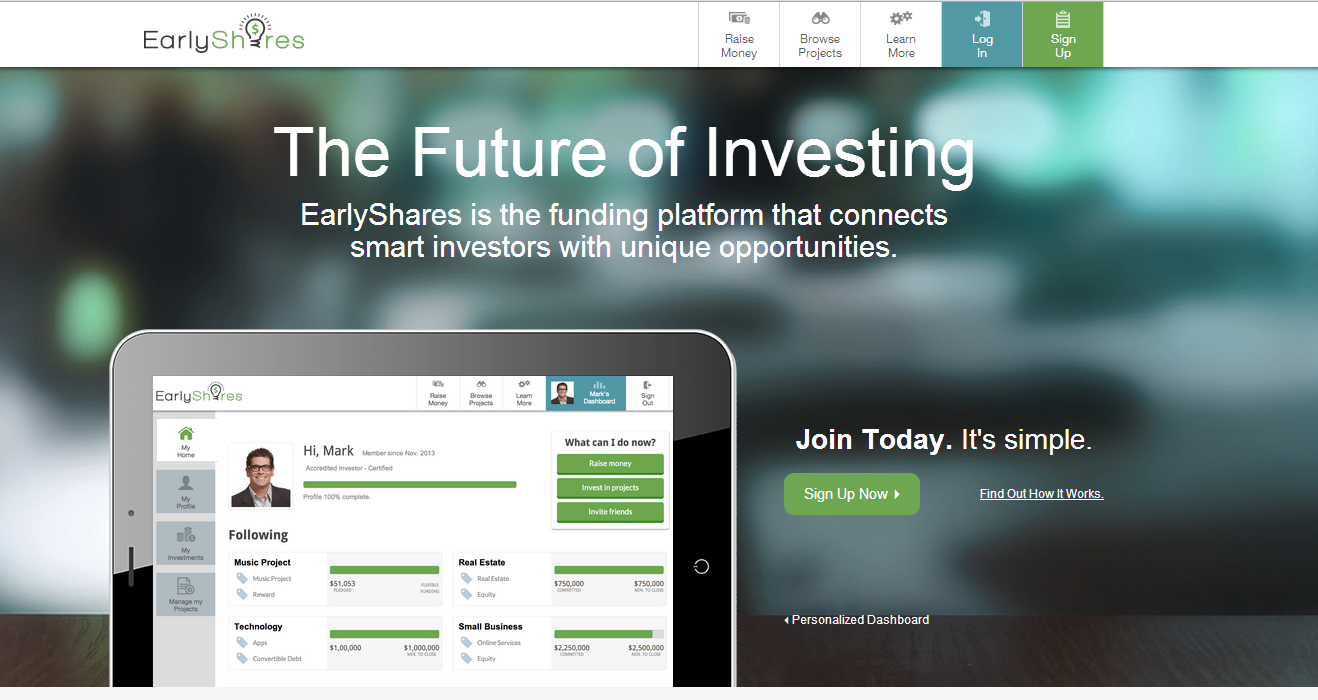

EarlyShares is an equity funding platform that connects passionate entrepreneurs with smart investors. We’ve developed the funding platform of the future – a safe, secure, compliant environment where investors can find unique investment opportunities across a wealth of industries and help entrepreneurs fund their passions.

EarlyShares hosts equity- and rewards-based crowdfunding campaigns and ‘general solicitation’ investment offerings. We work with strategic partners in real estate, entertainment, music, and enterprise web to attract exciting investment opportunities in each channel for our community of ‘EarlyShareholders.’

Equity investment opportunities on EarlyShares are currently only open to Accredited Investors. Once the SEC’s rules for equity crowdfunding are implemented, we plan to transform the $2 trillion market of early-stage financing by facilitating “crowd” investing and redefining what it means to be an equity owner in a business.

EarlyShares is based in Miami. I co-founded the company in 2011.

Please tell us a little bit about your background and how you started your company?

I’ve been in finance for over 25 years as a trader in addition to being an entrepreneur. EarlyShares isn’t my first company – I founded Lincoln Partners Group, a venture capital fund, in 1999 and Lincoln Capital, a hedge fund, in 2003.

My EarlyShares co-founders and I knew when the JOBS Act came about that the legislation would completely transform investing as we knew it. As entrepreneurs, we knew firsthand just how hard it is for small businesses and startups to gain access to capital. Even though small businesses are the biggest job creators in our economy, data show that only around 2 percent of early-stage businesses acquire financing through traditional avenues.

The JOBS Act created exemptions that change the game of small business financing, so we created EarlyShares to give businesses access to new sources of capital. Entrepreneurs drive economic growth by following their passions – and our mission is to connect them to investors who can help them succeed.

What are some of the projects you are working on right now?

We just launched the first JOBS Act Title II “general solicitation” offering on EarlyShares for BoatSetter, a Miami-based startup in the recreational boating sector. BoatSetter is a peer-to-peer “collaborative commerce” initiative that connects boat owners to qualified renters. They’re conducting a combination equity-plus-rewards campaign on our platform that’s going really well – they’ve already received more than $620,000 in commitments toward a $1 million raise.

Our next equity offerings for PaletteApp, an online tool serving the architecture and interior design communities, and Kleo, an online banking service for schools and teachers, will both launch very soon. There are a number of other interesting deals in our pipeline, as well.

I’ve personally focused strongly on our partnerships in entertainment and music. Our EarlyShares Music vertical has its own president, Stokes Nielson – a very successful musician and entrepreneur whose band The Lost Trailers raised $250,000 on our platform to record and promote a song called “It’s Going Down Tonight.” This past season you could hear the song across the country every week on the Westwood One radio network as part of its NFL Sunday Night Football broadcasts. That’s a huge success facilitated through our platform, and Stokes is out there helping us find other great artists for potential equity offerings on EarlyShares.

What are your plans for the future, how do you plan to grow this company?

We’re conducting general solicitation offerings and rewards crowdfunding campaigns right now, but what we’re really excited for is true equity crowdfunding. Once the proposed Title III rules take effect and businesses can give members of the general public the opportunity to become owners, we’re going to facilitate a fundamental shift in what it means to be an “investor.”

Individuals, regardless of wealth, will be able to get more than just a reward or a discounted pre-order for supporting the businesses they believe in through EarlyShares – they’ll get actual equity ownership. That’s something very powerful that we can’t wait to bring to the masses.

Our plan is to keep the elements of what makes traditional crowdfunding so great for backers – the excitement of stumbling across a captivating project that you would never otherwise learn about, and the fun of earning rewards – and introduce the potential for profit. In the process, we’ll be democratizing access to capital for small businesses and startups.

People are clamoring to support the companies they believe in through equity crowdfunding. We can’t wait to make that happen.

What were the top 3 mistakes you made starting your business and what did you learn from it?

EarlyShares is a relatively new company that, with the help of my co-founders and CEO Joanna Schwartz, I’ve built on a very solid foundation. But in the past I’ve definitely made some missteps as an entrepreneur, and I think my three top mistakes were very intertwined.

For one, I definitely assumed I knew more than I did at an early age – which I think is very common among young entrepreneurs. I was also too aggressive and too ambitious too early in my career; I wanted to always be pushing forward on projects when I should have sat back and waited until I was sure I had it right. And I pushed myself to branch out into more and more projects in more and more areas all the time, when I should have focused my energy more directly on one thing.

Learning from those mistakes has been a matter of experience. With EarlyShares, my management team and I are completely focused on getting it right, even if that takes time and patience.

Please share some advice for new tech entrepreneurs, someone who’s just starting out

I think the number one mistake entrepreneurs make in any field is the same, and it’s one of the mistakes I made: branching out into too many areas, trying to be a jack-of-all-trades. It’s tempting to try to be every staff member you need on your team, but it’s nearly impossible to execute all of those roles well.

My advice would be to take the time to figure out what you’re really good, work on cultivating your skills, and surround yourself with people who have the talents you lack.

What was the best business advice you have ever received and who gave you this advice?

Starting out as a trader, someone once told me “Stocks don’t lie, people do.” It sounds like narrow advice but it applies everywhere in business if you really think about it: people may lie, but situations and numbers speak for themselves.

What are the top 3 online tools and resources you’re currently using to grow your company?

LinkedIn is crucial to our growth right now because it’s proving to be the most effective way to reach the right people. Twitter is also helping us share thought leadership on our changing industry and find great sources of news.

And I’d say our third resource is our own platform. We’ve developed state-of-the-art tools for investors and issuers, but we’re always working to refine and expand them into the most effective tools in our industry.

For one, we’re focused on the potential of our business dashboard for issuers. It enables business owners to gauge the level of interest in their companies and better know the people who are looking to invest. These business intelligence features are going to be vital to our growth.

What’s your definition of success?

I’d say it’s simple: Achieving goals and finding happiness in whatever it is you’re doing.

What are three books you recommend entrepreneurs to read?

Crowdfund Investing For Dummies: A plug for this book co-written by Sherwood Neiss, one of our valued advisors.

- It walks both entrepreneurs and investors through the new landscape of equity crowdfunding.

The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses

- It’s a tough time to launch a company, but this book outlines how entrepreneurs can be nimble enough to succeed in a changing marketplace.

The Crowdfunding Revolution: How to Raise Venture Capital Using Social Media

- More valuable insight for entrepreneurs on how to capitalize on crowdfunding.

What is your favorite entrepreneurship quote?

“It’s more fun to be a pirate than to join the navy.” It’s not just about entrepreneurship – it’s about cultivating a culture of passion and change in your company.’ – Steve Jobs

How can our community get in touch with you?

By email at stemes@earlyshares.com Twitter @EarlyShares