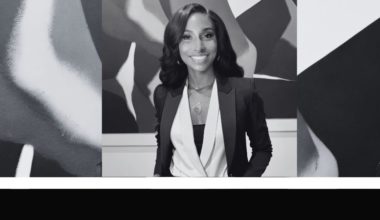

Christan Hiscock is the CEO and co-founder of Kardia Financial Group, which was born from the desire to change the financial services industry through heart-centered services that focus on what’s truly important; the people. Based in Calgary, Kardia Financial Group believes that the financial services industry should not be solely focused on dollars, but on helping people truly get to the heart of their financial goals.

Kardia Financial Group offers community building, real estate acquisitions, financial advising, accounting services, mortgages, credit solutions, and more. Christan Hiscock mentors CEOs on how to boost their companies’ team engagement, finance fundamentals, innovative thinking, investing do’s and don’ts, and more.

What is Kardia Financial Group all about?

Kardia Financial Group offers community building, real estate acquisitions, financial advising, accounting services, mortgages, credit solutions, and more. Kardia is the Greek word for ‘heart’, so the mission behind what we’re doing is creating a heart-centered approach in the financial services industry. Statistically, more than 90% of people in both Canada and the United States are not financially secure. Our goal is to bring education through all of our different divisions and the way that we do things to better equip our clients with the knowledge they need to understand money so that they can create financial freedom for themselves.

This ultimately leads to relieving one of the biggest stresses on people’s lives, which will help them think more about things that matter to them, spend more time with their families, and live more fulfilled lives through that process. We help individuals and businesses achieve this by assisting in relieving at least one aspect of stress they may have.

Tell us a little bit about your background and how you started your company?

I started my journey in the financial services industry in 2007. During my training, I fell in love with the industry because I saw that it was possible to make an impact on the lives of so many families. For nearly a decade, I thought about ways to change the very transactional financial industry into more of a heart-centered and educationally focused industry. I then set out to make this dream a reality.

What would you say are the top 3 skills needed to be a successful entrepreneur, and why?

I think that to be successful, an entrepreneur must be passionate, relentless, and impactful.

In business and entrepreneurship, you need to have passion — if you are passionate about it, that means that your endeavor is something that drives you deeper than just making money. It is more of a core thing in your life.

As an entrepreneur, you need to be relentless because it’s a world out there! A lot of stuff is going to happen, so you have to be relentless for your passions and to accomplish the goals that you have. You must also stay true to what you’re trying to do and realize that it’s not always going to go perfect. Things will go wrong, and you have to learn to adapt and grow in those areas.

Being impactful is important because it calls you to ask yourself if the actions that you’re doing inside of your company and elsewhere are making an impact beyond you. It calls you to work towards a higher standard for our world. Ask yourself, is my action impacting the environment in a positive way? Is it impacting my interpersonal relationships in a positive way? Is it impacting the economics of our city or our town? There are a lot of questions that you have to ask yourself if you want to run an impactful company.

What are your plans for the future, how do you plan to grow this company?

For our company, I put together a 9-year plan in the beginning. We are now in our fifth year, and our first three years were really about building awareness of who we are and our name. The next three years is about building the systems and processes to be able to scale. That really focuses on our hiring processes, our financial processes, our marketing processes… virtually all of the processes in the business.

During the next three years, as the CEO and visionary, I will try to break these systems by starting to scale. I will focus on both recruiting a lot of different people to be a part of our business and growing at a more rapid pace so that we can adapt our systems to be able to expand fast. After that, the sky’s the limit! We will just continue to build. My goal is to have 1000 employees and 10,000 contractors working for Kardia Financial Group one day.

What were the top three mistakes you made starting your business, and what did you learn from them?

One mistake was not adapting the roles of people on my team fast enough. I would hire fantastic people, but would let them stay working in a position or on a task that I knew wasn’t the best fit for them. I should have moved them into a different part of the organization. It’s not about firing someone fast; it’s about shifting their role and helping them adapt faster. The biggest mistake was not adapting the talent to fit the roles that I saw they should have been in.

Another mistake was not sharing enough of the financial burden. For me, I don’t like when other people have to go through hard situations. However, when we were in startup mode and always fighting to pay the bills or payroll, I held a lot of that burden. It was disempowering to my partners and team members to not allow them to go through that same experience. It also halted the ability to solve a problem faster; if I had more eclectic brains working to figure out how to bring in extra funds, we could have changed and adapted processes faster.

One last mistake I made was thinking in the early stages that mistakes were bad. The reality is, as entrepreneurs and visionaries, we are going to make mistakes because we are moving so fast. The fact is, if we are not making any mistakes, we are not growing and developing. The mistake I made early on was not allowing myself to feel the mistake as it was and learning to adapt to it faster without shame, guilt, or worrying about it.

Tell us a little bit about your marketing process, what has been the most successful form of marketing for you?

The best marketing for Kardia Financial Group is how we serve our community. We are in the financial services business, so we have a mortgage brokerage, real estate investing and development, financial advising, tax planning, and high net-worth initiatives (we have 12 companies under our banner). We are very big in the world community, and we do Instagram Live events called ‘At Home with Kardia’ every week. We do “Mindset Mondays’ and ‘Wonder Wednesdays’, where we host a visual and vocal artist in the evenings. For example, we will host a painter and a singer, or a dancer and a flute player. We also host ‘Financial Friday’ sessions on Instagram Live. Doing these Instagram Live sessions shows what we care about as a company: the wholeness of a human being in their life. We want to talk about their mindset, mental illness, and the arts, and these Instagram Live sessions have been the most powerful way that we connect with our community. It is all about being involved in your community in the way that your community needs you.

We started this initiative during the COVID-19 pandemic. People were locked in their houses and we thought of ways to support them. We launched all of these Instagram Live events to do just that.

What have been your biggest challenges and how did you overcome them?

Matching the growth of the personnel with the growth of the revenue. It’s like the cart before the horse conundrum — we have this big vision and so much that we want to accomplish, so we need the right personnel to help us execute our ideas. However, we also need to balance that with making sure we are executing enough on the revenue-driving side of the business. For companies with a very heart-centered approach such as ours, who are so focused on making an impact, sometimes this can be hard. We can be so focused on the team that is doing great things, but they are not bringing in enough revenue to ensure that those initiatives last forever. That is a challenge that we have worked through and overcame over the years.

What was your first business idea and what did you do with it?

My first business idea was a vending machine company. We had little boxes that we put in mechanic shops and offices around the small town I lived in. It was an honor system, so consumers could put a dollar in and grab a chocolate bar or bag of chips. Every week, I would go around to the boxes dispersed around the town to refill them and handle the money.

What are you learning now? Why is that important?

I’m writing about — and through that process, learning about – impact entrepreneurship. It starts with having a vision and being able to be a visionary leader. It also focuses on building world-class teams, so it is pertinent to know how to attract the right people to your organization and to your vision. I’m also learning about how to drive sustainable revenue and profit. Both of these factors are needed to create real impact. Revenue gives you the cash flow to hire new people and develop your team. Profits give you a business that pays for itself and builds a life for your family.”

If you started your business again, what things would you do differently?

If I would totally start over, I would implement 3- to 6-month sprints in each of the businesses. I would start these companies and implement sprints related to marketing and operations so that we could get the bases built. Rather than have the initial team (which is a lot smaller) work on like five to six projects at a time, I would schedule the projects out over the first three to six months of the businesses, all on a stacked schedule.

What’s a productivity tip you swear by?

I encourage others in their business pursuits, which in turn motivates me to also strive for success in my company.

What is your favorite quote?

“My favorite quote is:

Good, better, best. Never let it rest. Until your good is better and your better is best.

– St. Jerome

I really like this quote, as it is all about getting better for yourself.”

What valuable advice would you give new entrepreneurs starting out?

I have several tips for entrepreneurs. First, make sure there is a purpose of why you are launching your company. Having a set mission will help you stay strong and persevere forward when challenges arise. Also, celebrate the small wins. One of my mentors, Sharon Lechter, drilled that into me. This is very important, as it will help boost your everyday morale and keep you motivated in progressing your company. In addition, make sure the business is built to support you, rather than you needing to support the business. This will make your entrepreneurial journey much more fulfilling and less stressful.

Random Interview: Alex Valencia, Co-founder & President of We Do Web Content